No products in the cart.

Uncategorized

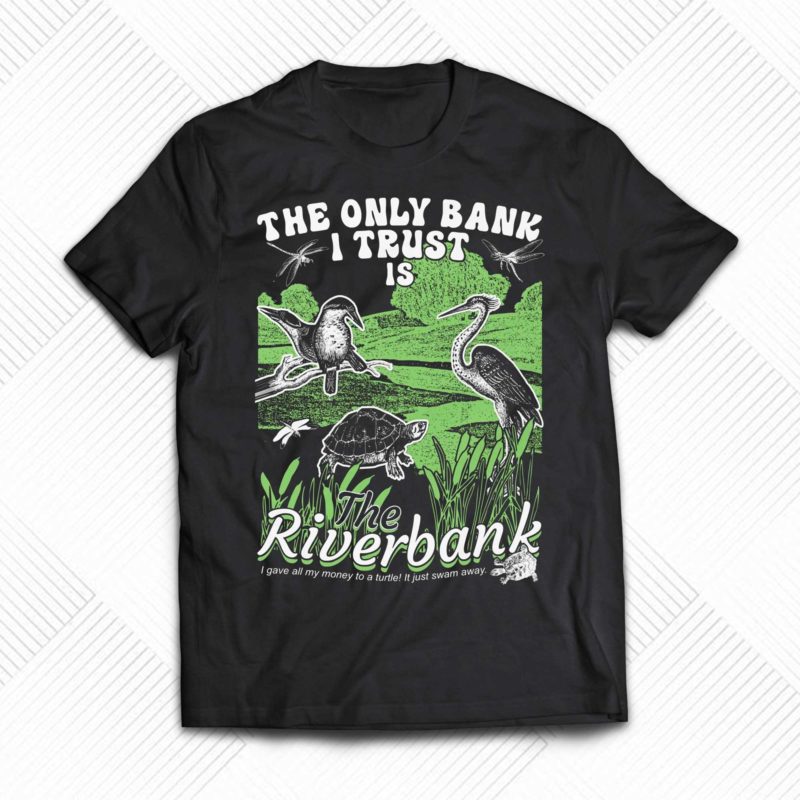

Dive into Confidence with “The Only Bank I Trust Is The Riverbank” Shirt!

Dive into Confidence with “The Only Bank I Trust Is The Riverbank” Shirt!

Are you tired of the traditional banking hassle? Yearning for a secure and serene financial sanctuary? Look no further! Introducing our exclusive “The Only Bank I Trust Is The Riverbank” shirt – a symbol of financial liberation and nature’s tranquility!

Why Choose The Riverbank?

- Stress-Free Banking: No queues, no paperwork. Just the soothing sound of flowing water.

- Nature’s Assurance: The riverbank symbolizes constancy, echoing the stability you seek in your financial choices.

- Unique Style: Stand out with this exclusive design that sparks conversations and radiates confidence.

- Premium Quality, Comfortable Fit: Crafted with care, our shirts guarantee comfort without compromising style. The premium fabric ensures durability, making it your go-to choice for any occasion.

Versatile Fashion Statement: Pair it with jeans, shorts, or even your favorite pajamas – our shirt complements any style. Embrace the casual elegance that speaks volumes.

Perfect Gift: Surprise your finance-savvy friends or family with this unique shirt. It’s not just clothing; it’s a statement they’ll cherish.

Join the Riverbank Revolution – Order Now! Seize the opportunity to redefine your style and financial philosophy. Limited stock available, so act fast! Click the link to order your “The Only Bank I Trust Is The Riverbank” shirt now!

👉 Order Now!

Embrace financial freedom with style – The Riverbank Way!

Analysis of CBN’s Decision to Remove CEOs of Union, Keystone, and Polaris Banks

In a recent move that has sent shockwaves through the financial sector, the Central Bank of Nigeria (CBN) announced the dissolution of the boards and management of Union Bank, Polaris Bank, and Keystone Bank. The decision, citing corporate governance lapses, regulatory non-compliance, breach of licensing terms, and involvement in activities posing a threat to financial stability, has sparked discussions among analysts.

The CBN, in a statement, emphasized that the action was a response to the banks’ non-compliance with the provisions of the Banks and Other Financial Institutions Act, 2020. The appointment of new executives to oversee the banks until new boards and management are reconstituted underscores the gravity of the situation.

Union Bank, which recently transitioned to private ownership, faced delisting from the Nigerian Exchange after Titan Trust Bank acquired majority stakes. The CBN’s move is seen as a necessary step to address various issues, including corporate governance, which has become a focal point in recent regulatory actions.

Speculation surrounds the CBN’s decision, with reports suggesting a forensic audit under the former CBN governor Godwin Emefiele played a role. A special investigator appointed by President Bola Tinubu allegedly found links between Emefiele and the acquisition of Union Bank and Keystone Bank through proxies. The report claimed that “ill-gotten wealth” was used to establish Titan Trust Bank, initiating a complex chain of ownership.

The involvement of “Dubai-based” firms as proxies has raised eyebrows, with doubts about their physical presence and legitimacy. The investigation also pointed to potential lapses in the acquisition process, further complicating the situation.

As discussions unfold, questions about the transparency of the banks’ operations and the regulatory oversight they received are gaining prominence. The aftermath of this decision will likely involve a thorough examination of the financial sector’s integrity, with potential long-term implications for corporate governance standards and regulatory frameworks.

In a statement, TGI, the conglomerate associated with the acquisition, defended the transparency of the transaction, stating that the capital used was “transparent and unimpeachable.” The unfolding events indicate a challenging period for the affected banks and an intensified focus on ensuring accountability and adherence to regulatory guidelines within the Nigerian financial landscape.